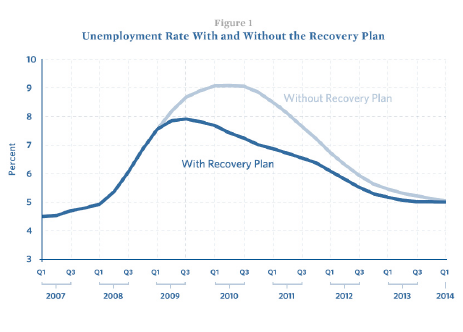

Back in January 2009, right after the inauguration, I posted a quick summary of views from economists about the expected effect of the stimulus. The stimulus was expected to be about 20% bigger than it ended up, but the basic gist was that doing nothing would mean high unemployment rates (9%) through 2010, and beginning to drop in 2011, finally returning to historical norms by 2014. Enacting the stimulus as it was planned was expected to lead to unemployment rates peaking at 8% in mid-2009, and dropping steadily through 2013. The recovery plan was supposed to lessen the worst and shorten the duration of the employment loss.

In January of 2010, I posted the followup, which was cautiously optimistic, while pointing out that unemployment was actually at 10%, but did appear to be declining slightly. Sadly, this trend was not borne out by the end of 2010. Here we are, over two years after the Bush administration began the economic recovery plan, nearly two years since the Obama administration compromised its way to a smaller stimulus devoted largely to shoring up banks with no guarantees of lending to actual citizens, and it seems the results are actually worse than what was expected from doing nothing at all. That’s just sad.

Here’s the latest unemployment figures from the Bureau of Labor Statistics. I sincerely hope you’re not one of the 10%. Happy New Year.

Categories

Categories Tag Cloud

Tag Cloud Blog RSS

Blog RSS Comments RSS

Comments RSS

Last 50 Posts

Last 50 Posts Back

Back Void

Void  Life

Life  Earth

Earth  Wind

Wind  Water

Water  Fire

Fire