There have been a number of articles written over the years about the relative size of different generations, and their respective power dynamics and interest in change.

The Baby Boom Generation (born 1946-1964) is about 29% of the US population. They were more numerous than the generation before, and once they rose to positions of authority in the business and political spheres, seem to have little to no interest in ever letting go. They are known for a lot of protesting and fostering some large changes in society, and then as they grew older, resisting any further changes. Also called the “Me Generation” for the perception of conspicuous consumerism, the Boomers are also known for prioritizing “hard work” (read: long hours) over productivity. They displayed great loyalty to the corporations that dominated the country during their early work years, and have a mindset that one career could be at one company for decades.

Generation X (1961-1981, yeah, there’s overlap – generations aren’t really solid blocs) is about 18% of the US population, and came of age during the multiple recessions of the post-Reagan years. Being a smaller group, they’ve struggled to attain any lasting influence, not helped by being labeled “slackers” when they were in their 20s. Gen X were the first generation of “latch key kids.” Due to the multiple hits of the Reagan recession, welfare reform, cutting funding for education, and the Dot Com Bubble, Gen X is the first generation that has little chance of doing better financially than their parents. Gen X is known for prioritizing merit and “bang for the buck” in business and politics. Downsizing and “right sizing” and offshoring have made Gen X assume a more mercenary approach to corporate loyalty, constantly prepared to jump ship if need be or if a great opportunity comes along.

Millennials (1981-1994 or maybe 2000, depending on who you ask) are another big generation, approximately 27% of the US population. While the parents of Millennials were known as “helicopter parents” to a great degree, the children they raised are more idealistic and less bigoted than most previous generations, in general. While Boomers and Gen X created the internet, Millennials grew up with it as part of the background. They are generally more comfortable with uncertainty and change in economic situations (see the gig economy) than previous generations. They also see the massive dump that Boomers took on the economy over decades in power and are pretty unhappy about it. Millennials generally look for people making a meaningful contribution in business and politics, rather than more objective measures of success.

In the business world, we see a lot of examples where Boomers are running the show, and the Gen X employees are biding their time, waiting to take over if the Boomers will ever fucking retire. And now, as Gen X is middle-aged, Millennials are entering the market at a high rate, and their energy is making them the up-and-comers. Gen X has more debt than income, and now it increasingly looks like their bosses will be their own children.

Meanwhile, over in politics, we see something similar. Look at the US House of Representatives. It’s like a senior citizen center over there. Nancy Pelosi is 78, her lieutenant Steny Hoyer is 79. Neither seems interested in retiring. The Senate is just as bad. Mitch McConnell and Bernie Sanders are both 76, and Dianne Feinstein has been legally dead for three years. There are a few Gen X folks in there, like Paul Ryan and Ted Cruz, but overall – pretty damned old. The House averages 57 years old, and the Senate 61. Gen X seems to mostly have given up on politics, because we’re trying to dig out of debt before we start drawing Social Security.

Nancy Pelosi doesn’t seem to believe that there has been a demographic and enthusiasm shift within the Democratic Party. Young folks are energized. Look at the primary in New York, where a 28 year-old woman, an avowed Democratic Socialist, just beat someone who has been in office since she was in 3rd grade. Pelosi’s response: I’m sure it’s nothing. The rise of the various street protests and online activism, leading to the surprisingly good showing of Sanders in 2016 and the lack of enthusiasm from the Democratic faithful during the general election, should have been some kind of wakeup call. Ignoring the energy and passion of Millennials is not a wise move.

On behalf of the forgotten middle child of generational warfare, may I say to the Millennials – go get ’em.

You can call it multi-level marketing, you can call it network marketing, you can call it Alfred, but the facts are that MLM-based home businesses are almost universally pyramid schemes (even if they are technically legal) that will drain money from 98 percent of the participants. It’s sad to see how many people get sucked into the ever-growing array of these things.

There are a wide array of articles in the wild that will give many details on why MLMs are generally poor businesses to get involved in. I’ll give a few links to those throughout and at the end, but I want to just look at things from a basic critical-thinking viewpoint first. The main issues with MLMs that I see are that they require you to create your own competition; and that in order to be financially secure, you need to be at the top of the line, which is almost certainly not the case for anyone who didn’t invent the particular business franchise. A couple other points are how much you’ll alienate everyone in your life, and how most MLM-based products are either over-priced or utter garbage.

Competition

So you want to sell cosmetics, or hair care products, or weight-loss devices, or whatever it is that the particular “business opportunity” your best friend got you to buy into over drinks one night. That’s cool. But, the day of door-to-door sales is over, so how do you get people to buy your thing? You could set up a real storefront, but that requires even more money as a sunk cost before you make sales. You could go to vendor shows, but you’ll soon find that there are five Scentsy distributors at every major show, so how do you get traction there? And as you get frustrated not making sales, that bestie who got you started will be there to tell you about passive income. This amazing feature of the multi-level sales model allows you to make money when someone else sells something. All you have to do is go out and recruit people to sell in their own area and you can get a piece of their pie as well as your own. Wow, that’s amazing. But wait a minute – where are they selling, and where is your mentor selling? You all live in the same town, and now you are all trying to sell the same thing to the same market. Gee, that seems sustainable.

There’s a reason you see one guy owning multiple Burger King franchises spread across a city, but you don’t see a BK owner encouraging someone else to build a Wendy’s next door – businesses generally don’t want more competition if they can avoid it. Yet, the MLM model essentially requires that you create your own competition in your own town. The only way to really make any significant down-line income is to recruit more than one person to compete against you. And then you end up with five Scentsy distributors at every show.

Getting Rich

Math is hard. People tell us that all the time. And some math is hard. But simple two-dimensional geometry is not that difficult. Almost anyone can figure it out.

Many MLM plans suggest getting five down-line distributors working for you at each level. So, your five direct “subordinates” would also recruit five people each. And now you’ve got 30 competitors trying to sell the same perfume you’re selling. But, you no longer even try to sell anything, because you’re managing your down-line. And how long can that down-line build? Well, funny you should ask. Let’s look at each “generation” down the line, and you’ll see how difficult it is to make money if you’re not at the very top of the food chain.

One generation below you, five people. Each of the first generation recruits five people and that’s 25 in the second generation. Each of them recruits five people, and that’s 125 in the third generation. There are 625 in Gen4, over 3000 in Gen5, and the entire population of the earth couldn’t fill the thirteenth generation. This looks a lot like a very fat pyramid, but I’m sure that’s merely a coincidence.

Who makes money at MLMs? The founders. They get people to work for them, and the top couple tiers even have a good chance at making a lot of money. Once you get below four levels from the top, you’re lucky to make anything like a real salary. And for most of us, the middle class and working class folks that see an opportunity that only requires a small initial investment – you’re the one paying for the folks above you. Herbalife’s “supervisors” (the top 20% of their distributors) have a median net income of $0 from Herbalife; imagine what the other 80% must be making! Well over 95% of MLM distributors or vendors (or whatever fancy word that means “participant” they use) lose money. When Amway was sued in 1982, the state of Wisconsin found that the average income for a direct distributor (which is one that has a down-line working for them) was a loss of nearly one thousand dollars per year. Adjusted for inflation, that’s over $2500 today. In 1995, over 65% of NuSkin’s profits went to 200 of their 63,000 distributors. Yes, 99.7% of the people lost money or broke even.

Alienation of Affection

If you use social media, you have almost certainly seen many posts from friends, family, and acquaintances who are trying to get you to come to their product party. Yay, day drinking and playing with makeup! Wooo! And then she tries to get you to be in her down-line, and the hangover hits hard. Nobody wants their friends to harass them to buy their stuff. This is not a thing that anyone has ever hoped for.

But, if you want to maintain that passive income, you need to be actively seeking new members of your team, and helping your down-line members recruit more members as well. You can’t just rest on your laurels, because people quit. People quit MLMs as soon as they realize they’re never going to make more money than a real job, or when their spouse tells them they have enough damned Mary Kay and now they can’t afford the bankruptcy lawyer they are definitely going to need soon. In 1999, a big MLM company stated in court that their drop-out rate was one of the lowest in the industry, at a mere 5.5% per month. So, those thirty people in the two levels right below you? One of them needs to be replaced every few weeks, if you’re lucky. In 1995, Excel Communications stated they had a drop-out rate of over 85% per year. Hopefully you’re good at making friends, because you’re going to be annoying the hell out of the ones you already have.

Hard to Sell

An Amway distributor named Sidney Schwartz thought that Amway’s analysis of their products, where they claimed to be cheaper than their competition, was flawed. His own analysis, which he posted for the world to see (in contrast to Amway’s summary-only approach) showed that most of their products were about twice as expensive as equivalent products at the grocery store. At least nobody claims Amway’s soaps and cereals are garbage; they’re just pricey.

Many of the products sold through MLM companies fall into the over-priced category. Some of them joyfully embrace that, such as Pampered Chef. Marketing luxury products at prices above the local store is easier to do than marketing commodity items for luxury prices. The various MLM jewelry companies (Stella & Dot, Premier Designs, etc.) generally sell necklaces and bracelets you can find nearly anywhere for less. It Works, the much-hyped body wrap that was everywhere in 2015, very clearly does not work despite its name.

Conclusion

I’ve got a small business. I’m not in any way opposed to entrepreneurs and the entrepreneurial spirit. But, if something seems to good to be true, or if it seems too easy, it’s wise to be skeptical. If someone is trying to help you start a business, it’s a good idea to ask what they’re getting out of it before you commit.

With the KARE Crafts business, I have attended many local vendor shows. Most of them have been craft shows, and everything there is made by hand, by the people selling it to the public right there in their booths. It’s authentic, it’s real, and it’s almost universally a bargain. Going to general-interest vendor shows can be a very different experience. The vendors have to compete to get in because most small shows only want one of each MLM brand represented, and even in a small city like San Angelo (population under 100,000), there are more Younique and Scentsy distributors than are sustainable. It’s like the small business equivalent of a strip-mall. You know, no matter where you go in the USA, you’ll see the same Tupperware and Herbalife products.

Worse than the sameness and blandness of the MLM dominance of small businesses, though, is the lack of profitability. I’d much rather see my friends and acquaintances making money for themselves than losing money in the likely-vain hope that one day they’ll get the big check.

Additional Reading

It Works does not – a quick explanation of how there’s no way “It Works” actually works

Report to FTC detailing how 99 percent of MLM participants lose money

Amway: the Untold Story – one distributor’s story of his years selling Amway products

Pink Truth started as a community to discuss the truth behind Mary Kay’s pink façade, but they’ve grown to include forums covering a lot of other MLMs that target women (which is their traditional target)

False Profits promotes a book by the same name, but has a lot of articles discussing the various “get rich” schemes, including MLMs and Ponzi schemes

If you’re passing around something saying that Congress and federal judges are exempt from the Affordable Care Act, you’re passing around bullshit. There is no health care program called “Obamacare” to be exempt from or to participate in. The federal government’s health insurance already complies with the mandates for coverage contained in the PPACA, so they don’t need to change. Is that “exempt” or is that “already compliant with” in your mind?

Congress is a special case. The GOP inserted language in the PPACA to require congresscritters and their staff members to participate in the health insurance exchanges, rather than stay on their (already PPACA-compliant) federal health insurance. This was a weird thing to do, as the exchanges were intended to be available to people who did not otherwise qualify for employer-provided or other health insurance. It was a deliberate political ploy to portray “Obamacare” as so repellent that the Dems would reject the provision. That ploy failed. They neglected to include language in the law regarding whether the government (as the employer) would continue to pay for the health insurance or not. The OPM issued a ruling this summer saying that, unless another law is passed changing it, the government will still be authorized to pay the same portion of the insurance premium they do for other federal employees. Is that an “exemption” or is that a “unique situation contrived to be as insane as possible” to you?

Many of these memes passing around also state that unions are exempt from “Obamacare.” Since that is still not a specific thing from which to be exempt, what could they possibly mean? Many unions got waivers from a particular provision of the law, which would have required coverage caps to rise to $750,000 by last year and be gone entirely by next year. Some companies and unions didn’t want to pass that expense on to their employees, so they asked for and received waivers until 2014. At that time, the waivers for coverage caps will go away. It’s kind of an exemption, but not from the full force of the law. And, it’s going to go away in a few months. So…not really “exempt from Obamacare” after all. Oh, and only 25% of the waivers have gone to unions, but you know how much the Right hates unions. Now, personally, I would have denied the waivers for caps. That particular provision was intended to prevent people from running out of insurance if they had a long period of illness or an expensive procedure. It’s somewhat inhumane to allow some people to be subject to caps, but not others.

There are some groups which are completely exempt from any health insurance mandate. The two biggest groups are Native Americans and some religious groups. The religious groups which are exempt are the ones which are also exempt from paying into (and drawing from) Social Security, such as the Old Order Amish, and groups which have a mutual self-aid system in place that essentially has everyone pay for anyone’s health care in the group. Also, if you make so little money that you don’t even have to file a federal tax return, you are exempt from the mandate. You’re also in a really crappy life.

Anyway, anything to do with the Affordable Care Act is complex and hard to nail down to just a quick meme, but don’t believe everything that you read just because it feels truthy to you.

So, you think the seemingly interminable debate about debt ceilings and deficits might wane for a few months, now that the gummint has forestalled a default by doing what it has done seventy times in the past 50 years? Don’t be ridiculous.

The Grand Compromise (i.e., give the GOP nearly everything they demanded in order to not destroy the global economy) requires the debt limit be raised in three stages. The first stage went into effect immediately; it will cover until around the end of September. Yes, that’s right – it only covers 8 weeks. When that runs out, the President can raise the limit again, and Congress gets a chance to disapprove it. They might actually eke out enough votes to disapprove the raise, which will then be vetoed and the raise goes into effect. Then, the GOP can blame the President for raising the debt limit arbitrarily and autocratically and against the Will of The People. All of that is nonsense, of course. Every sane member of the GOP knows the debt limit has to be raised if we are to avoid a truly stupendous economic meltdown that would make the Great Depression look like a boom time.

Also coming up at the end of September is the expiration of the federal gasoline tax. You didn’t even know that tax had an expiration date, did you? That’s because nobody (before 2000 anyway) has ever contemplated not having it. The 18.4 cents per gallon that we pay to that tax pays for the majority of the budget of the Highway Trust Fund. That fund pays for things like ensuring the interstates don’t disintegrate into gravel roads. Amusingly, the Democratically-controlled Congress under President Clinton’s administration created an increase in the gas tax which was earmarked exclusively to deficit reduction, but then got shifted four years later by a Republican Congress toward the Trust Fund. Even then, nobody tried to reduce the tax; they just used it for something different.

Just to pile on, September 30th is also the expiration of the current continuing resolution that permits the federal government to spend any money whatsoever. The current budget was agreed to in April of this year (after 14 months of debate), and if you don’t remember the fun of that “debate,” you’re blessed by ignorance indeed. You’d think that maybe the Congress could actually pass a budget this year, but I wouldn’t hold out too much hope for that piece of sanity.

So, good job, Republicans – you’ve made the budget into the single issue which will define the year before the 2012 elections start. And that can only help your candidates, many of whom would really rather there not be a federal government for them to be a part of and are doing their best to ensure its failure as a sane and rational governing body. Good luck finding a Presidential candidate that isn’t crazy but can pass the GOP primaries, because the 2012 election is yours to lose.

So, once again, we see the great Change agent deal with a recalcitrant GOP by a complete and utter capitulation. What does the President point to as a vital program which he has protected during this Great Compromise? Even Medicare and Social Security, which were considered sacrosanct by both parties not that long ago, are going to be looked at by the new and improved bipartisan debt reduction commission later in the year. Apparently the first debt reduction commission didn’t provide the correct answers that anyone wanted last year.

Meanwhile, the GOP gets to claim success in all their areas. No tax increases, even on the wealthiest people (they aren’t Job Creators just because the GOP says so; they need to actually create jobs to be worthy of that title) or greediest tax-dodging corporations (which have already taken their profits off-shore, so what threat do they have left?). And, the debt debate will continue through the election, providing a nice millstone for Obama to drag around.

Yay for change.

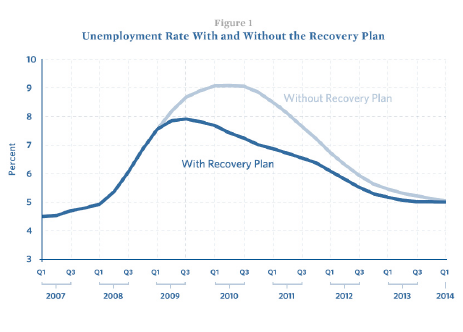

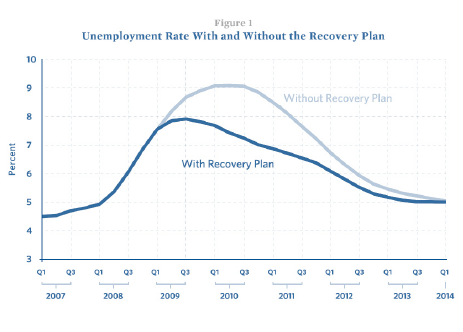

Back in January 2009, right after the inauguration, I posted a quick summary of views from economists about the expected effect of the stimulus. The stimulus was expected to be about 20% bigger than it ended up, but the basic gist was that doing nothing would mean high unemployment rates (9%) through 2010, and beginning to drop in 2011, finally returning to historical norms by 2014. Enacting the stimulus as it was planned was expected to lead to unemployment rates peaking at 8% in mid-2009, and dropping steadily through 2013. The recovery plan was supposed to lessen the worst and shorten the duration of the employment loss.

In January of 2010, I posted the followup, which was cautiously optimistic, while pointing out that unemployment was actually at 10%, but did appear to be declining slightly. Sadly, this trend was not borne out by the end of 2010. Here we are, over two years after the Bush administration began the economic recovery plan, nearly two years since the Obama administration compromised its way to a smaller stimulus devoted largely to shoring up banks with no guarantees of lending to actual citizens, and it seems the results are actually worse than what was expected from doing nothing at all. That’s just sad.

Here’s the latest unemployment figures from the Bureau of Labor Statistics. I sincerely hope you’re not one of the 10%. Happy New Year.

Repeat after me: “Taxes are lower than ever before in this generation. We are NOT being overtaxed.”

It’s interesting that we’re shifting the tax burden to employment taxes rather than income taxes, and we’ve completely gutted the wealth taxes. But, we must ensure that the uberwealthy get an extra 100,000 dollars in tax relief, rather than the mere $4000 they would have without this capitulation. Remember, even without an extension of the tax cuts for income above $250,000 – everyone was set to have lower income taxes than before the “temporary” cuts of 2002. Marginal tax rates are not effective tax rates. Oh, and when Eric Cantor says half of all small business owners would have faced higher taxes (and therefore fired people obviously), that’s just a lie. The average small businees income is $40,000/year. That’s far below $250,000 for those who are bad at math (GOP – I’m looking at you). Now, here’s where it gets fun. Only 2.5% of business owners would have faced higher taxes, but those businesses account for 44% of the business income. So, if you want to claim that half the income from businesses would be taxed higher, you’re not far off. But, to claim that half of all small businesses would have been hit – that’s just bull. Also, there’s no solid definition of “small business” so maybe Cantor is thinking that Walmart and Best Buy are small. After all, Eric Cantor’s wife makes millions per year – wonder where his loyalties lie.

This photo essay provides an interesting look into the country Afghanistan was starting to become before the Soviets started the seemingly never-ending wars that have plagued the nation for forty years. Textile plants and women college students and cabinet meetings where the members actually had higher educations…sad to contrast that with today.

According to an in-depth AP article today, the War on (some) Drugs is an abject failure. This should surprise just about nobody, although apparently there are some who remain shocked to find gambling at Rick’s Cafe as well.

The current Director of the Office of National Drug Control Policy, Gil Kerlikowske, even admitted on record that “In the grand scheme, it has not been successful.” Naturally, his predecessor, John Walters, takes the opposite tack: “To say that all the things that have been done in the war on drugs haven’t made any difference is ridiculous. It destroys everything we’ve done. It’s saying all the people involved in law enforcment, treatment and prevention have been wasting their time. It’s saying all these people’s work is misguided.” Sorry to say, Mr. Walters, but you can’t change reality just by wishing it wasn’t just a giant waste of time and money.

One trillion dollars spent over forty years, in order to prove that Prohibition was not an anomaly? We’ve been inundated with “Just Say No” and DARE and other programs, yet high school kids have the same rate of drug use today as in 1970, when Nixon kicked this thing off. $450 billion has been spent to incarcerate drug offenders in federal prison (no mention of how much states spend in addition), where most data indicates incarceration leads to increased drug usage when released.

Portugal decriminalized drug use in 2001. Decriminalization is not legalization – it just means a user won’t go to jail for doing drugs; the drugs themselves remain illegal to deal. I know, strange but that’s the legal system for you. In the years since, HIV infections from dirty needles have dropped by 70%, and drug overdoses have dropped by 30%. Also, the rate of young people using drugs has dropped, and the number of people seeking drug treatment has doubled. 10% of Portuguese have used marijuana in their lifetimes; in the USA that number is close to 40%.

The United States has 5% of the world population but 25% of the world’s prisoners. We must be doing something wrong.

The people screaming about high taxes this week are insane. The simple truth is, taxes are low – lower than most of us have seen in our lifetimes.

According to the Tax Foundation, which actually does something called research and something else called math, there’s a simple method to determining how bad taxes are – Tax Freedom Day. This is the day when you’ve worked enough to have finished paying the government share of your labor and begin to earn the remainder. This year, it’s the second-earliest day in their records (which go back to before the Johnson administration); last year was the earliest. As of April 9th, on average, Americans have worked to pay off their tax burden for the year. That’s 99 days of 365 that we work just to pay the overhead (27% of our income goes to taxes of various types). Now, some might say that’s too high. If you believe that it is, fine – but you must be intellectually honest and realize that it’s less than you’ve ever paid in your life (for my generation anyway), and if you didn’t bitch about the tax burden in 2000 when you had to work until May 1st to hit Tax Freedom Day, you’re not being consistent.

On the other hand, spending is crazy. The main reason that Tax Freedom Day is so early this year is because we aren’t paying for what we’re buying. If we actually had to pay taxes that balanced the budget, Tax Freedom Day would be … wait for it… May 17th. Democrats can’t be fairly called “Tax and Spend liberals” right now – they’re more like “Don’t Tax and Spend Anyway crypto-liberals” instead. Only 1998-2001 were we paying the debt down instead of building it up. Heck of a way to balance a budget.

These dates are all averages, and are based on federal and state combined numbers. Each state has vastly different tax structures, so Alaskans get to start earning their own money on March 26th while folks in Connecticut have to wait until April 27th.

You almost have to feel sorry for the Republican party this year. Their tactics of screaming loudly, encouraging their followers to scream incoherently, and basically kicking and yelling “no!” have failed to prevent the (watered down) health care reform bill from passing. Already, they plan to introduce legislation to repeal it. Since they could never produce more than a dozen pages of counterproposal, I suppose a “make it go away” bill is about the right length for their proven abilities.

One thing that seems to be a truism in American politics is that everyone is against government spending except when it is something they want.  Also, every new entitlement becomes an entrenched permanent benefit as soon as it becomes law. Look at the fact that we still have tobacco farming subsidies, even while we do our darnedest to make tobacco usage less popular than a vampiric leper zombie.

Now that the health care reform bill has become law, the GOP is in the unenviable position of trying to reduce benefits and remove people’s health insurance. It’s easy to rant against the evils of socialism, all while ignoring that many of our institutions are socialized (police, fire, road work, military, yada yada). It’s a lot harder to tell people that, for their own good, you’re going to make it okay for insurance companies to more easily deny coverage to their sick mother. Not to mention, the CBO came out with their estimate that this bill will reduce the deficit, which makes the “it costs too much” rhetoric feel a little hokey.

Some of the provisions of the health care reform bill that become effective this year:

- Insurance companies can’t drop your coverage if you become sick while insured

- Parents can insure adult children up to 26 years old

- The Medicare “donut hole” will get a rebate, eventually becoming a solid bismarck-like holeless mass

- Children will not be barred for pre-existing conditions

- Lifetime coverage limits will be gone

- Small businesses will get a tax credit to help provide health insurance for their employees

Of course, John Boehner is upset that one other provision goes into effect this year: tanning beds get a 10% additional tax. I love that taxes are seemingly randomly associated with anything they are meant to assist, but tanning salons? Weird.

So the GOP is going to be campaigning this year to repeal this law. They will be out there telling their constituents and voters that they want senior citizens to pay $250 more for their medication, that they want to deprive small businesses of a tax credit, that they want to deny coverage to little Jimmy with leukemia… yeah, that’ll work.

A year after I posted the “with and without stimulus” economist projection, it’s interesting to see how things have actually panned out.

What expert economists said they expected:

You can see that the projection was that we’d peak at around 8% unemployment, with the stimulus that was proposed. A much smaller stimulus was put into place, and it peaked about 10% instead. But, the projections also said we’d see see a plateau and reduction in unemployment right around the beginning of 2010, and we did. So, it’s been a bit worse than projected, but it’s turning around right on schedule. Of course, it’s still too early to see if this plateau is done and we’re actually recovering, or if we’re just going to plateau until the end of 2010, which would be what was projected to happen without any government intervention. That would suck.

You can see that the projection was that we’d peak at around 8% unemployment, with the stimulus that was proposed. A much smaller stimulus was put into place, and it peaked about 10% instead. But, the projections also said we’d see see a plateau and reduction in unemployment right around the beginning of 2010, and we did. So, it’s been a bit worse than projected, but it’s turning around right on schedule. Of course, it’s still too early to see if this plateau is done and we’re actually recovering, or if we’re just going to plateau until the end of 2010, which would be what was projected to happen without any government intervention. That would suck.

One year ago, I made a series of 10 predictions for the new year. Let’s see how I did.

- The right wing noise machine did find new and interesting ways to make themselves look silly while calling the new president a socialist, a communist, a nazi, and a racist – all at the same time. If President Obama were on fire, the GOP would call fire departments a socialist plot, as John Scalzi wrote this week.

- Windows 7 did not save the computer industry.

- Netbooks were a bit easier to find than I feared, so there’s one point against me. To be fair, the good netbooks were harder to get hold of, so maybe half a point.

- Yep, suck.

- No single sign-on system of any note, although Facebook is getting a lot of headway into “sign in with Facebook” on various sites. Maybe we’ll count this as half and half.

- No crypto.

- DTV changeover was, although delayed yet again until June of 2009, not a crazy display of incompetence and weeping and gnashing of teeth. Got this one wrong.

- Politicians continued to line their pockets by picking ours, and gave as much largesse to their corporate overlords as possible. Sadly, I got this one right.

- Weather was much remarked upon. Denialists continued to deny reality. Climatologists turned out to sometimes be jerks, but that overshadowed that the science continues to be reinforced with evidence.

- Kit dropped me from her “LJ Friends” list after 9 years (no idea why), so I have no idea how amusing she is.

Let’s see, that gives me 6 of 10 completely right, 2 partly right, one completely wrong, and one I can no longer assess, so I can’t use it for any statistics. We’ll call it 7-2 or 78% accurate. I’m sure that beats all the “psychics” out there. Now, what shall I predict for 2010? Stay tuned.

In 1989, I enlisted in the Army, partly because the economy in California was in the dumper. In 1992, I reenlisted for much the same reasons, although the rest of the country had generally recovered from the Reagan-era recession by that time. I thought it was odd that California, a state which by many estimates could be in the top ten countries’ economic stature, would be in such doldrums. California has transportation, tourism, energy production, entertainment, manufacturing, agriculture – in short, everything you need for a robust state. Yet, it continues to be hammered harder and sooner and for a longer period than most of the rest of the country even today. So, the 1980s aerospace collapse isn’t the only reason; there must be some explanation for why California seems incapable of maintaining a healthy economy.

Over the years, as I grew older and more curious, I discovered what seems the most likely explanation: Californians hate taxes but love spending. Since states can’t spend into deficit territory like the federal government can (too bad CA can’t issue money, eh?), they must balance the budget. So, every one of those propositions people vote for has to come from somewhere. I dug around a bit more and discovered the proximate cause of this insane situation: Proposition 13. Whenever someone would talk about how crazy high the housing prices in California were, I would opine about Prop 13 and the caps on property taxes and the 2% limit on valuation increases per annum and the disincentive to selling and friction in the housing market and their eyes would glaze over. When the housing bubble burst and friends and family lost jobs, businesses, and homes, I would think back to the Proposition 13 consequences and commercial properties paying a lower percentage of the taxes every year due to shell corporations and other legal legerdemain. But, I had a hard time tying all the pieces together for my friends who have never lived in California, and I didn’t have a great summary of how far the state has fallen, from the great public schools that my older sister went to in 1974 until the much deprived public schools that my younger sister went to in 1990.

Now, I’ve come across a journalist who writes a very concise and cogent explanation of exactly what went wrong with the California economy. If you’re curious about how the Golden State has become the Gilded State in a mere 30 years, you should read it. I find it interesting that CA had a large budget surplus, and Moonbeam Brown wanted to hoard it, which caused the Governor Ronnie backlash in 1978. Talk about unintended consequences.

Just saw a Citi commercial touting their ability to make wise investment decisions. I beg to differ. They asked the U.S. government for a bailout, if you recall. When any company needs to ask me for money, I question their business acumen.

The CBO analysis of the stimulus is available online. If you really want to know what the impact of the stimulus may be, read it for yourself. Don’t believe whatever talking heads say. Especially don’t believe what they said last week, before the analysis had been released. Lying bastards. It’s true that the CBO says much of the money won’t be spent in federal fiscal year 2009. If you think about it for a few seconds, you’d realize this is blatantly obvious. FY 2009 started in October, so it’ll be about one-third over before the bill becomes law. Then, it still takes time for things to get moving. The “quick” moves won’t be able to add money to the economy until April, half-way into the fiscal year. A multi-year stimulus which has a lower impact in a 6-month “year” than in the following 12-month year? SHOCKING! A quote from the NY Times seems to be aghast that it may take a few months to a year to get some construction projects moving. Yeah, well…have you seen how long it takes to complete or even plan major construction projects? Boston could tell you.

One thing the CBO won’t tell you, quite explicitly denoted on the front page of their report, is what return on investment we can expect for each provision, or the bill as a whole. No matter what Marie Cocco says, the CBO doesn’t make those predictions. But, most economists agree that tax cuts (while nice and I’ll take any money the government sees fit to give back to me) are not as effective as you might think. Turns out, most of us actually save some of that money when we get it, rather than immediately spend every dime. One typical comment:

“People are going to spend 30, 40 cents on the dollar, so the multiplier is going to be low,†said Adam S. Posen, deputy director of the Peterson Institute of International Economics.

So, according to the vast majority of respected economists, including those with Nobel prizes, the stimulus might work, but it might be too late for anything to make things better in the short term. Even Christina Romer (President Obama’s economic adviser) thinks the stimulus will only slow the growth rate of the unemployment rate in the near term, bringing it back down in two years. But, they all agree that to do nothing is definitely not going to do anything of value.

“We have very few good examples to guide us,†said William G. Gale, a senior fellow at the Brookings Institution, the liberal-leaning research organization. “I don’t know of any convincing evidence that what has been proposed is going to be enough.â€

Christina Romer, whom Mr. Obama has designated to be his chief economist, concluded in research she helped write in 1994 that interest-rate policy is the most powerful force in economic recoveries and that fiscal stimulus generally acts too slowly to be of much help in pulling the economy out of recessions, though associates said she now supports a big stimulus package if policy makers roll it out early enough in the recession.

Adam Posen, the deputy director of the Peterson Institute for International Economics in Washington, said Mr. Obama’s plan could provide just the right boost — if it was carried out properly.

Alan J. Auerbach, an economist at the University of California, Berkeley, said the overall scale of the program looked “reasonable†at $800 billion over two years.

“It’s much bigger than anything that’s been tried in my lifetime, but this is scarier than anything we’ve seen in my lifetime,†Professor Auerbach said.

For those who point out that Romer once said that throwing money at a recession doesn’t work – no. You’re wrong, that’s not what she said. She said that monetary policy is better to use than fiscal policy. Unfortunately, the interest rates are at zero now, so there is no more room for monetary policy. Fiscal policy is what we have available, so that’s what we’re stuck with.

For those who think that tax cuts or tax rebates are better than paying for infrastructure buildouts – no. You’re wrong, and almost no economist agrees with you.

Mark M. Zandi, chief economist at Moody’s Economy.com, a forecasting firm, told a forum of House Democrats this week that the “bang for the buck†— the additional economic activity generated by each dollar of fiscal stimulus — was highest for increases in food and unemployment benefits. Each dollar of additional money for food stamps yields $1.73 in additional economic activity, Mr. Zandi estimated, and each extra dollar in unemployment benefits yields about $1.63.

By contrast, Mr. Zandi estimated, most tax cuts produce less than a dollar for each dollar of stimulus, especially if the tax cuts are temporary, because people save at least some of their extra money.

Joel Slemrod, a professor of tax policy at the University of Michigan, said, “The research I’ve done on the 2001 and 2008 tax rebates suggests that the proportion of the rebates that went to spending was rather small, about one-third.â€

I look forward to more random people throwing up logical fallacies. How about, “argument from personal incredulity?” That’s always a good one. After all, if something doesn’t make sense to you, I’m sure that highly trained economists have spent no time at all on it and it’s all just a guess to them too. Over 140 economists, including 5 Nobel Prize winners, support the stimulus package. If you want to convince me of your point of view, bring more expert opinion than that.

It seems the vast majority of military active duty and veterans I have ever met are vehemently opposed to socialized medicine for the country. If you’re using socialized medicine, why do you want to deny it to others?

Previous Entries

Previous Entries

Categories

Categories Tag Cloud

Tag Cloud Blog RSS

Blog RSS Comments RSS

Comments RSS

Last 50 Posts

Last 50 Posts Back

Back Void

Void  Life

Life  Earth

Earth  Wind

Wind  Water

Water  Fire

Fire